On July 31, the White House issued an executive order (EO) modifying reciprocal tariff rates under its International Emergency Economic Powers Act (IEEPA). This followed closely on the heels of a separate executive order on July 30th, specifically targeting imports from Brazil. These EOs outline changes to the original reciprocal tariff rates announced in April, but which had been on hold. The new rates take effect for any shipments that are not loaded onboard their final form of transport (i.e., ship) by this Thursday, Aug. 7, and apply to green, roasted, soluble, and decaffeinated coffee.

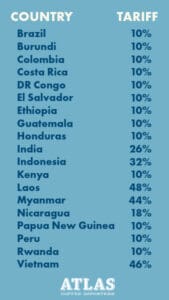

As a reminder, the tariff is charged to the importer at the time of customs clearance into the United States and is calculated based on the invoice we receive from our supplier. According to the EOs, impacted coffee-producing countries and the associated tariff rates are:

We encourage you to reach out to your representatives in Congress to let them know how the tariffs are impacting your business.

Meanwhile, several challenges to the President's authority to invoke IEEPA as a justification for tariffs are working their way through the legal system.

We will continue to publish additional updates as we have them.

THE FOLLOWING WAS ORIGINALLY POSTED ON 4/9/25

In the (almost) words of Ferris Bueller, "Tariff policy moves pretty fast. If you don't stop and look around once in a while, you could miss it."

As you have likely seen in the news, a 90-day pause has been declared on the “reciprocal” tariffs, effective immediately. However, the 10% universal tariff is still in effect and will be applied to any shipments that departed the country of origin after April 4. This applies to all our coffee-producing origins, other than (currently) Mexico.

The calculation of the final tax will be based on the import value of the coffee as determined by our FOB purchase invoice. In this volatile market, this means that the basis for our 10% tariff could be based on a contract that the producer price-fixed at the height of the market, not the current market price.

We will follow the latest developments and make pricing adjustments based on the best information available at the time. Please reach out if you have any questions about specific contracts.

THE FOLLOWING WAS ORIGINALLY POSTED ON 4/3/25

Following the Trump Administration’s tariff announcement on Wednesday, we wanted to share our current understanding of how these changes will impact our clients. As we have seen in recent months, policies can shift quickly, so this is very much a “what we know right now” assessment and more details will follow as we get more specifics on implementation.

What We Know

A 10% baseline tariff will apply to all imports. However, some countries will face significantly higher rates, as shown in the table below. We’ve edited the list to coffee origins that we currently import from.

As we understand it, the pause on the 25% tariffs from Mexico and Canada remains in effect; however, if coffee from Colombia, for example, is decaffeinated in Canada or Mexico and then imported into the U.S., the tariff for the coffee’s country of origin will still apply.

What this Means for You

In order to maintain a healthy business and continue our work of facilitating supplier and roaster partnerships, we unfortunately must pass along the charges as they are incurred.

This news is as disappointing to us as it is to you, and we know that high market prices have already put financial stress on your business.

What You Can Do

We are actively working to find any relief available and will continue to keep you updated. We also strongly encourage you to call your representatives and let them know how these tariffs are impacting your business.

We truly value your partnership and are here to answer any questions.